Accumulated depreciation formula

Accumulated depreciation is the cumulative depreciation of an asset up to a single point in its life. Depreciation is estimated at 20 per year on the book value.

Accumulated Depreciation Definition Formula Calculation

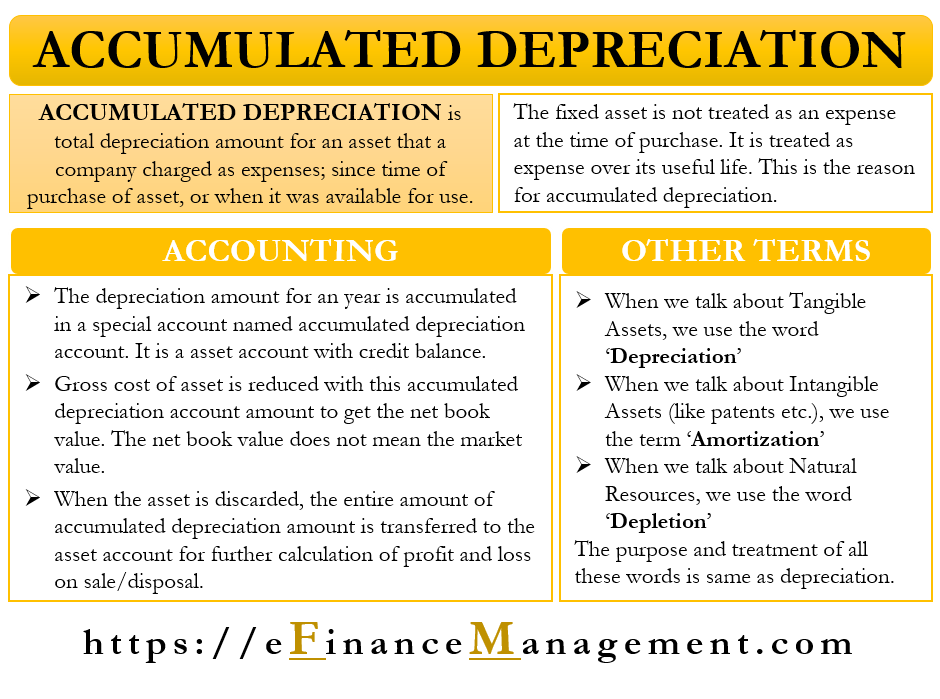

Accumulated depreciation is the contra asset account Contra Asset Account A contra asset account is an asset account with a credit balance related to one of the assets with a debit balance.

. An assets carrying value on the balance sheet is the difference between its purchase price. Use this calculator to calculate an accelerated depreciation of an asset for a specified period. Applying the formula So the manufacturing company will depreciate the machinery with the amount of 10000 annually for 5 years.

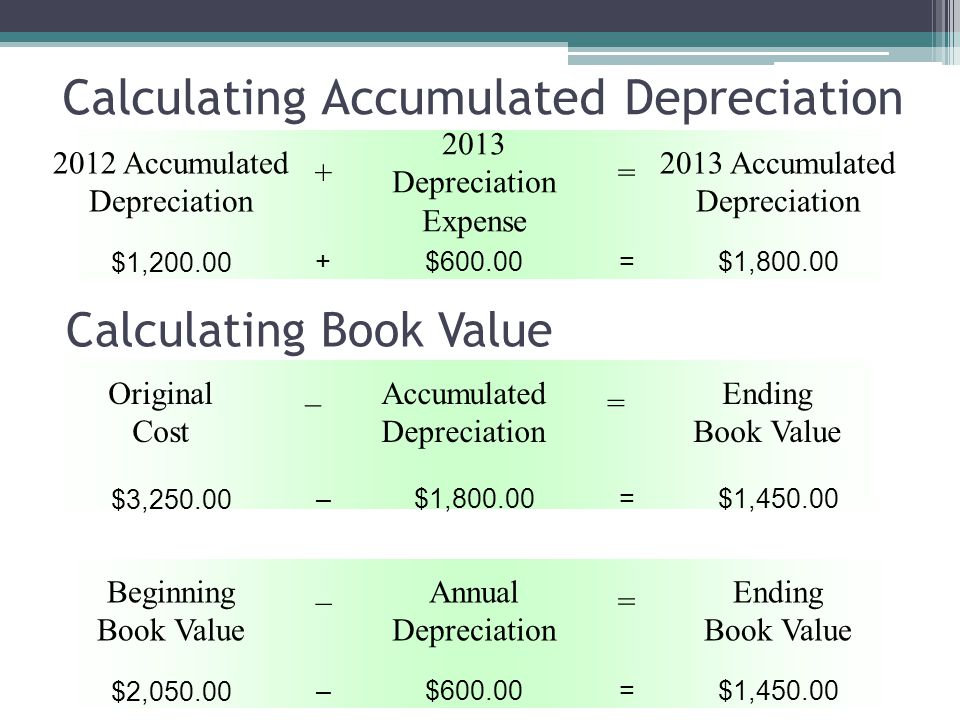

Finally the formula for depreciation can be derived by dividing the difference between the asset cost step 1 and the accumulated depreciation step 8 by the useful life of the asset step 3 which is then multiplied by 2 as shown below. Accumulated depreciation recorded Accumulated Depreciation Recorded The accumulated depreciation of an asset is the amount of cumulative depreciation charged on the asset from its purchase date until the reporting date. To calculate this value on a monthly basis divide the result by 12.

On 1 January 2016 XYZ Limited purchased a truck for 75000. Company X considers depreciation expenses for the nearest whole month. Example of straight-line depreciation without the salvage value.

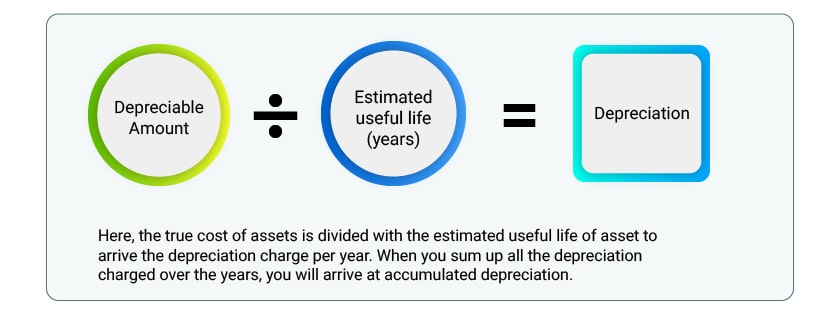

You can use the following basic declining balance formula to calculate accumulated depreciation for years. Owns machinery with a gross value of 10 million. The decrease in the value of a fixed asset due to its usages over time is called depreciation.

There are many depreciation methods that the entities could use. Still in the article we will discuss two depreciation methods that are normally used to calculate depreciation for the entity fixed assets and how accumulated depreciation is related to the depreciation. Accumulated depreciation is the total depreciation of the fixed asset accumulated up to a specified time.

The salvage value is Rs. Annual depreciation expense 60000 - 10000 50000. A depreciation factor of 200 of straight line depreciation or 2 is most commonly called the Double Declining Balance MethodUse this calculator for example for depreciation rates entered as 15 for 150 175 for 175 2 for 200 3 for 300 etc.

If you want to assume a higher rate of depreciation you can multiply by two. Accumulated depreciation totals depreciation expense since the asset has been in use. Total yearly depreciation Depreciation factor x 1 Lifespan of asset x Remaining value.

Mathematically we can apply values in the below equation. Depreciation rate is the percentage decline in the assets value. The formula for calculating straight-line depreciation is as follows.

Figure out the assets accumulated depreciation at the end of the last reporting period. Purchase or acquisition price of the asset - estimated salvage value of asset useful life of asset straight-line depreciation As you can see this formula is fairly simple to perform and offers a straightforward estimate as to the depreciation value of an asset. Calculating Depreciation Under Reducing Balance Method.

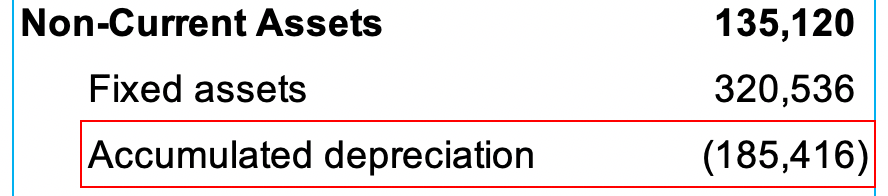

Book value is found by deducting the accumulated depreciation from the cost of the asset. When we add the balances of these two assets we will get the net book value or carrying value of the assets having a debit balance. Calculate the trucks depreciation for 2016 2017 and 2018.

After having all the values in hand we can apply the values in the below formula to get the depreciation amount. Book value Cost of the Asset Accumulated Depreciation. It is a contra-account the difference between the assets purchase price and its carrying value on.

The company takes 50000 as the depreciation expense every year for the next 5 years. On April 1 2012 company X purchased a piece of equipment for Rs. Thus after five years accumulated depreciation would total 16000.

3200 x 5 16000. This is expected to have 5 useful life years. Read more ie an asset account having the credit.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-02-b230b73e49c3406ba7b944172f09a624.jpg)

Why Is Accumulated Depreciation A Credit Balance

Depreciation Of Fixed Assets Double Entry Bookkeeping

Accumulated Depreciation Explained Bench Accounting

Depreciation Formula Examples With Excel Template

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Overview How It Works Example

Accumulated Depreciation Calculator Download Free Excel Template

Depreciation Formula Calculate Depreciation Expense

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Meaning Accounting And More

Straight Line Depreciation Accountingcoach

Accumulated Depreciation Definition How It Works Calculation Tally

Accumulated Depreciation Definition Formula Calculation

Depreciation Formula Examples With Excel Template

Accumulated Depreciation Calculation Journal Entry Accountinguide

Accumulated Depreciation Accountingtools India Dictionary